It's not what you think.

Traditional investment advice goes something like...

- Put your money in blue chip stocks

- Sprinkle in some ETFs, mutual funds, and precious metals

- Look at real estate if interest rates aren't too high

It's an easy, safe approach.

The classic "set it and forget it" dynamic.

As a long-time sales professional I've followed these principles.

And still abide by a few of them today.

But I've learned that by sticking solely to these traditional methods...

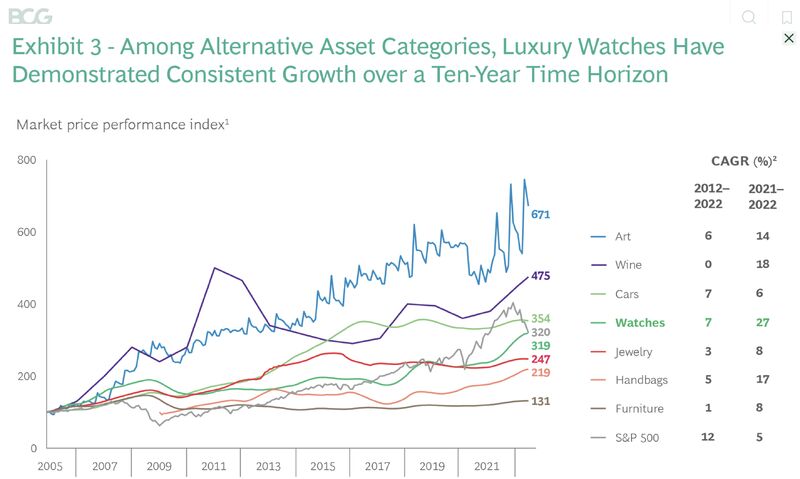

…top sales people are completely missing an asset category that has outperformed the S&P 2X the past 10 years.

It’s time to move beyond conventional mindsets.

It’s time to take a serious look at luxury watches as an investment class.

A class that not only grows in value YoY…

…but that acts as compelling social proof for customer onsites, President’s Clubs, or SKOs.

I’m not talking about Rolexes by the way.

Only 8% of the Rolex portfolio is worth parking your money into.

I’m talking about the Royal Oak from Audemars Piguet.

Omega’s James Bond editions, Cartier’s Santos, the IWC Top Gun Series.

Knowing the right models to buy.

Where to source them.

And how much to pay.

Is the real key to maximizing your portfolio and your style.

I know you probably think I'm crazy.

But trust me.

Ongoing data from sources like BCG say otherwise.

The research is actually pretty insane.

If you're interested in learning more.

Or want basic guidance on how to start leveraging luxury watches as an asset class.

Shoot me a connection request or drop me a DM.