Luxury Watches Are More Than Status Symbols. They’re Serious Assets

For years, luxury watches have been admired for their craftsmanship, style, and status symbol appeal. But today, the conversation has shifted dramatically, recognizing them not just as fashion statements or mechanical art, but as a legitimate and compelling asset class. The secondhand watch market, once associated with confusing data and authenticity risks, has transformed into a

transparent market supported by online information, authentication services, and knowledgeable participants.

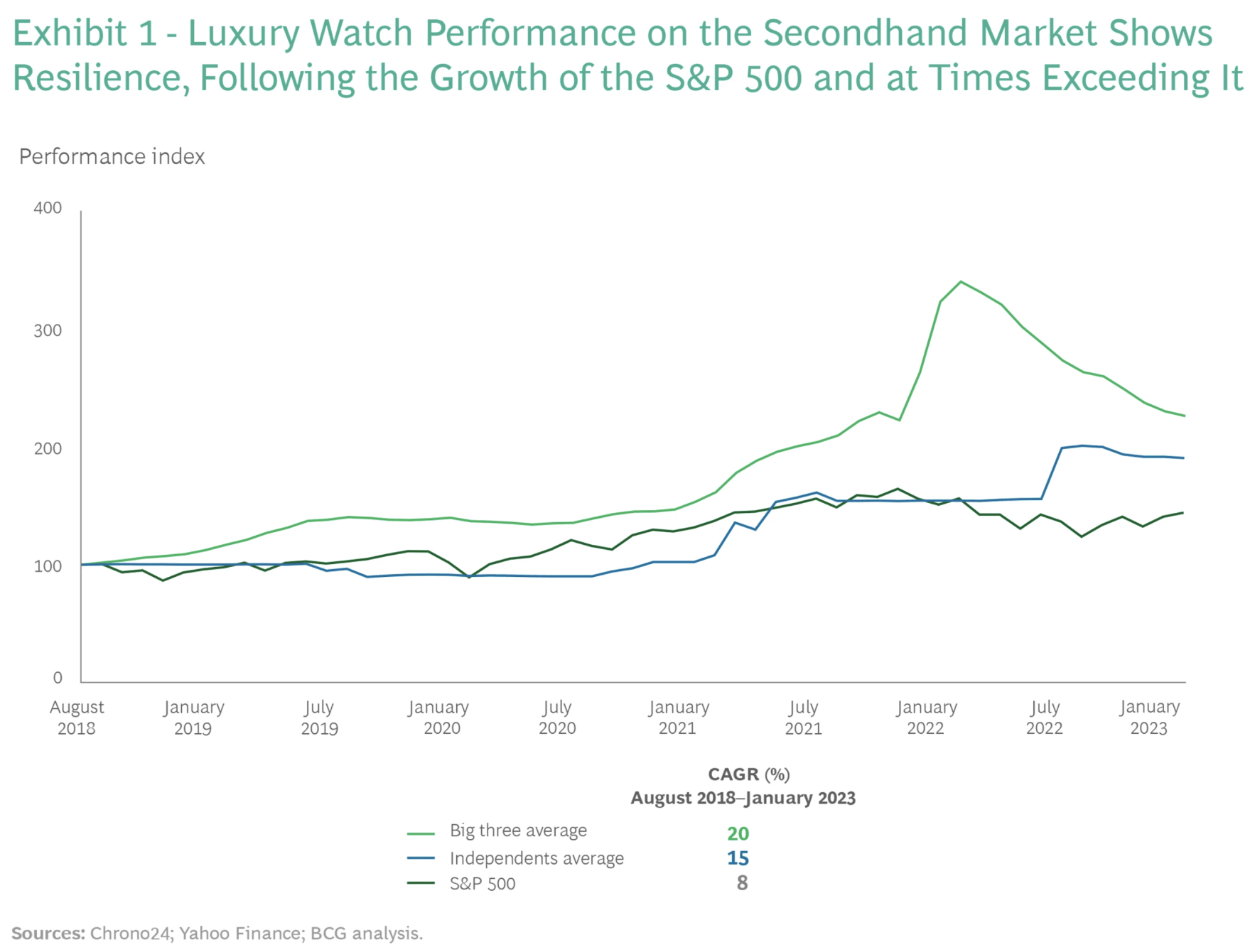

Evidence from sources like a recent Boston Consulting Group study highlights this evolution. The secondhand market for luxury watches is commanding more recognition than ever, fueled by growing buyer interest and scarcity. Luxury watches are now in demand as alternative investments, with buyers paying significant premiums for preowned models from top brands like Rolex, Patek Philippe, and Audemars Piguet, expecting their value to continue rising. The market performed particularly well from August 2018 to January 2023, with average prices for top models from Rolex, Patek Philippe, and Audemars Piguet rising at an annual rate of 20%, significantly outperforming the S&P 500 index at 8% annually during that period. Over a ten-year span from 2013 to 2022, watches grew in value at an average annual rate of 7%, surpassing other collectibles like jewelry, handbags, wine, art, and furniture, according to tracked indices.

More recently, luxury watches have demonstrated a notable ability to act as a store of value and safety during the trade war. For the past 12 months, secondary values on the all gold Patek Philippe Nautilus have mirrored the rise of spot gold. Money flows to safety, and watches, especially those with precious metals, serve this purpose. This behavior is seen predominantly with not only Patek Philippe but Rolex and Audemars Piguet as well. Even during the market downturns of 2022, watches performed well relative to stocks, and they recovered quickly from the 2008 crash.

Success in this market hinges on understanding market dynamics and making informed buying decisions. Paying full retail price at a boutique often leads to instant depreciation as large as 50%+. The exceptions are only a very small percentage of the Audemars Piguet, Rolex, Richard Mille and Patek Philippe portfolios. This is why buying pre-owned is often recommended; by positioning yourself correctly, you are protected with minimal downside risk. Brands like Panerai, Omega, IWC, Breitling and others can offer significant value plays, with recent models often available at 50%+ off MSRP on the secondary market. Knowing the right models, where to source them, and how much to pay is crucial for maximizing value and style.

One significant concern that historically plagued the pre-owned luxury watch market is the risk of encountering fakes. While fakes are out there, "buying the seller, not the watch" protects buyers from the risk. In other words, the best sellers in this business value their reputation far more than the profit from a single fraudulent sale.

To protect yourself in any deal, ask these key questions about the seller before you buy the watch:

- Does the seller have a public profile?

- Can they be found easily on platforms like Google and LinkedIn?

- Are they willing to have a video call?

- Will their network vouch for them?

If a legitimate seller were to mistakenly sell a fake, they would refund the payment, take the watch back and remove it from circulation.

Beyond investment, another unique quality of luxury watches is that they can be a powerful tool for elite business networking. Wearing a preowned timepiece that you bought at a significant discount is a great brag; helping to break the ice and build rapport just as much as any rare or unique timepiece. Simply wearing the most common Rolex, like a Submariner, might not spark conversation and can even project a lack of knowledge to true enthusiasts. Instead, wearing something less common but notable, like certain Ulysse Nardin or Blancpain models acquired at attractive secondary market prices, shows you're an intelligent buyer and can create an interesting story, profiling you as a connoisseur.

Watches possess another unique trait; they're portable, wearable art. Increasingly, manufacturers are paying attention to colors, artistic elements, and beautiful movements, marking a shift in the industry towards viewing watches as art. This trend of "artistic" or dynamic design watches is strengthening. Brands like Ulysse Nardin are doing incredible jobs with this, creating pieces that are seen as both high-end technical marvels and art. Hublot is another key brand noted for its exciting, conversational design that fits this "wearable art" trend. Both brands offer exciting “ice-breaker” potential in business networking for these qualities. This characteristic allows luxury watches to uniquely combine the appeal of a high-value conversational piece along with the investment potential associated with fine art.

Luxury watches are more than just accessories; they're sophisticated assets with proven investment performance, a unique artistic dimension, and the potential to unlock significant personal and professional opportunities. TimelySoles helps top performing professionals navigate this market with the right insight, understanding, and strategic thinking.